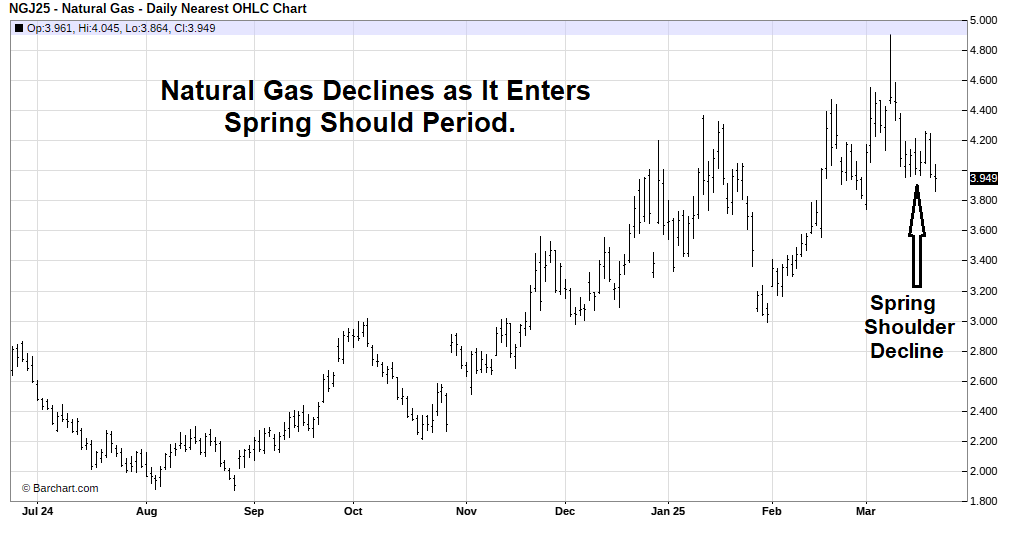

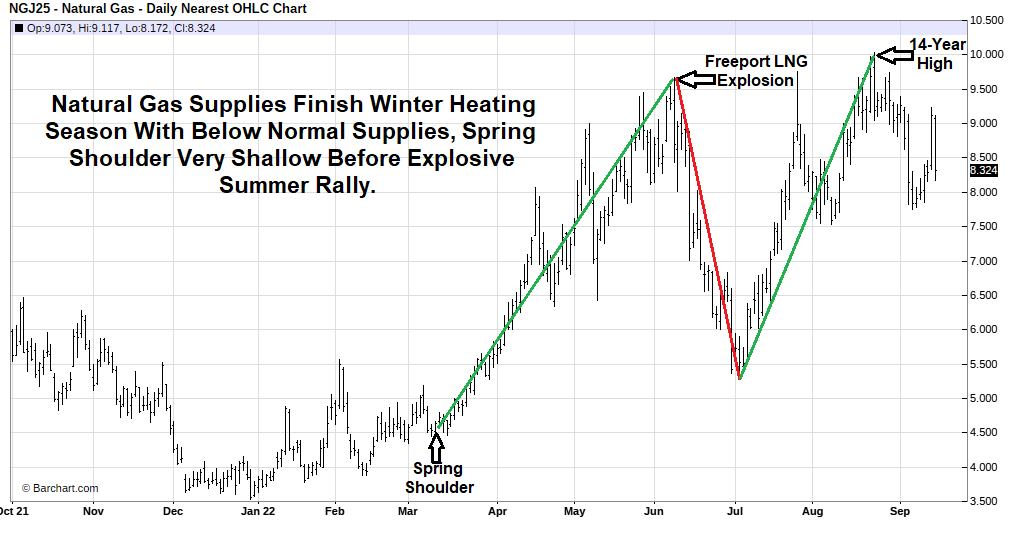

Energy News: Natural Gas Decline into the Spring Shoulder Period an Opportunity to Hedge the Cost of Natural Gas and Electricity?

Energy news report: March 24th, 2025 Natural Gas Decline into the Spring Shoulder Period an Opportunity to Hedge the Cost