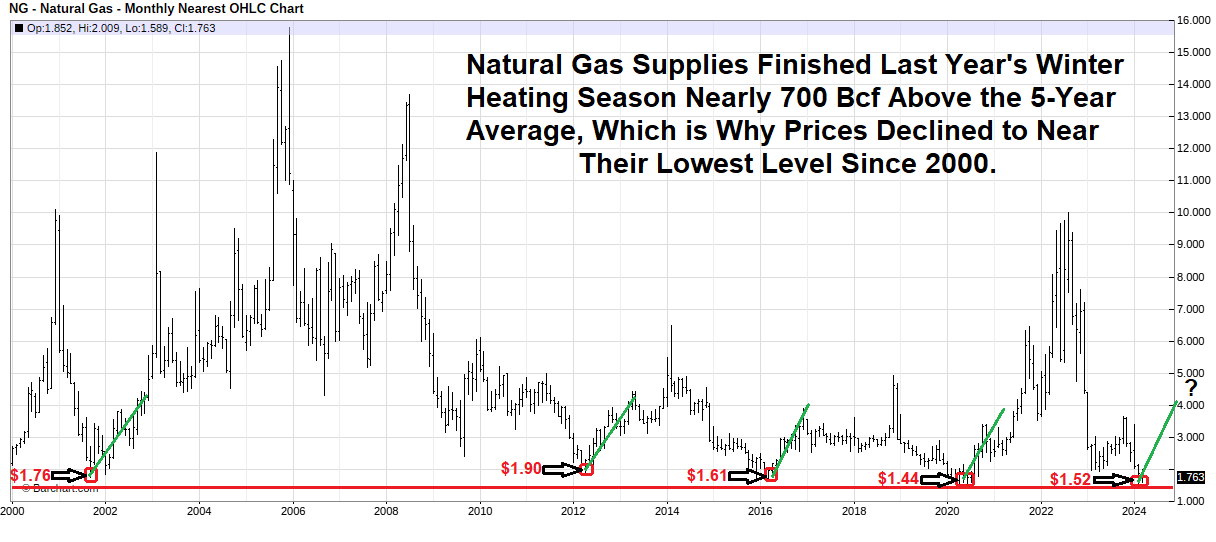

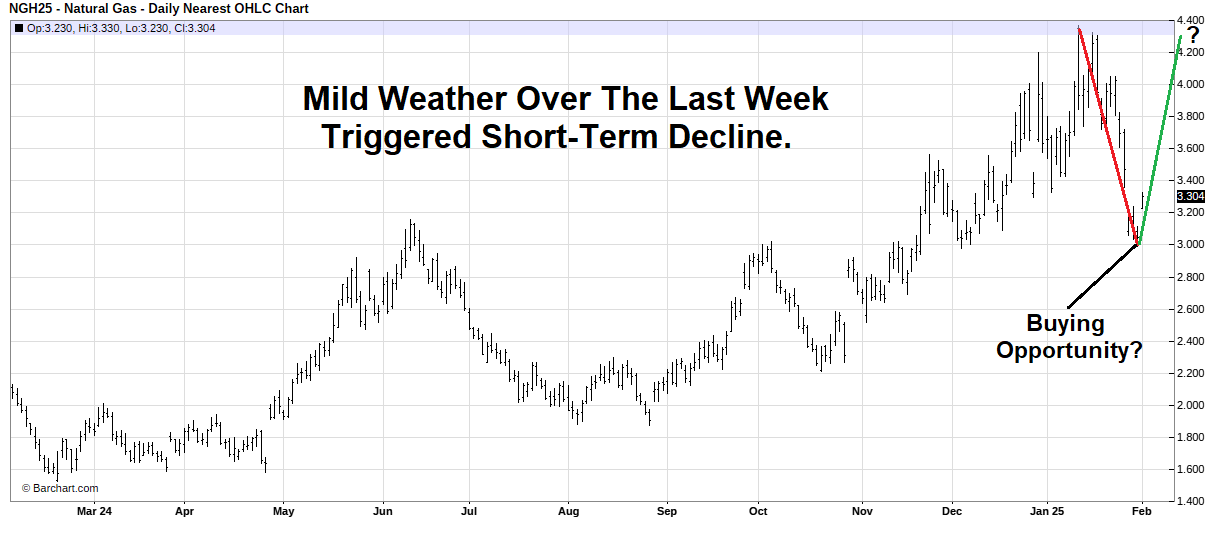

Energy News: The EIA’s Latest Weekly Storage Report Continues to Support Higher Natural Gas Prices Long-Term

Energy News: February 3rd, 2025 The EIA’s Latest Weekly Storage Report Continues to Support Higher Natural Gas Prices Long-Term https://youtu.be/BaPoRCeSO5c