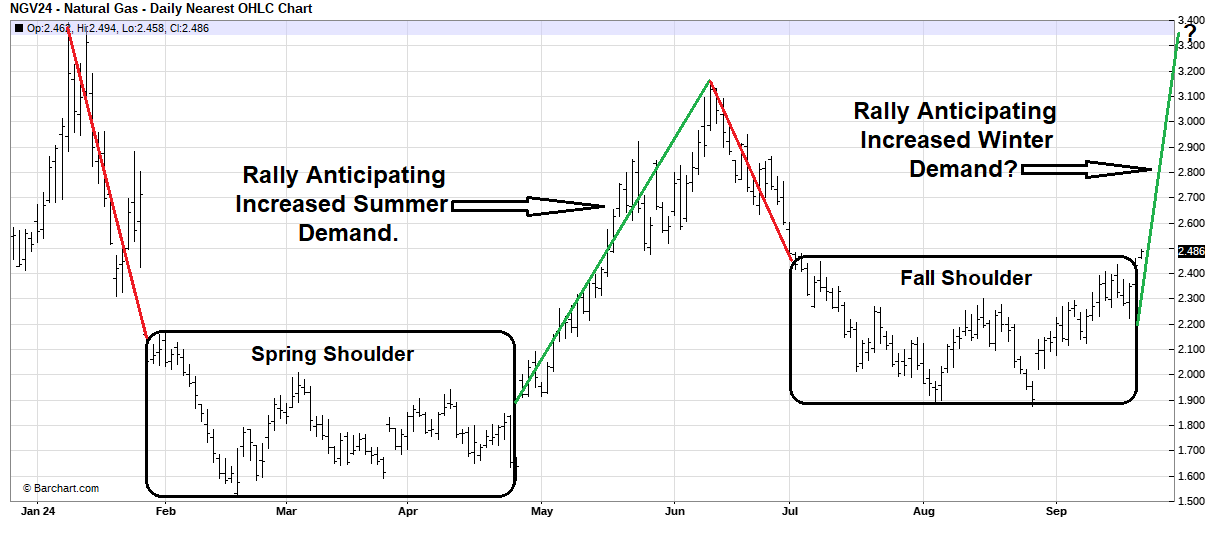

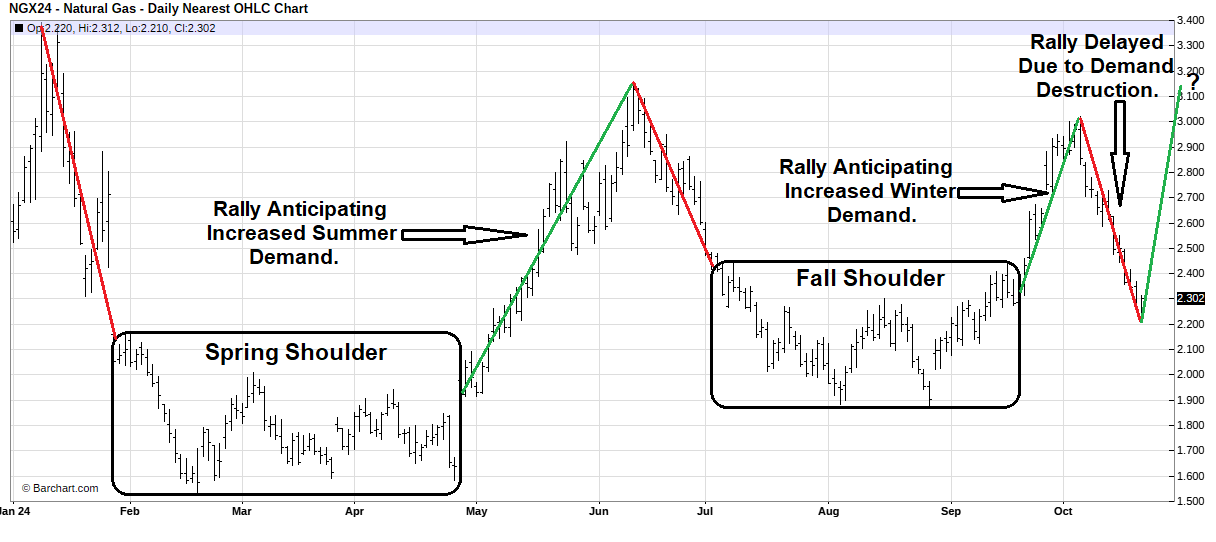

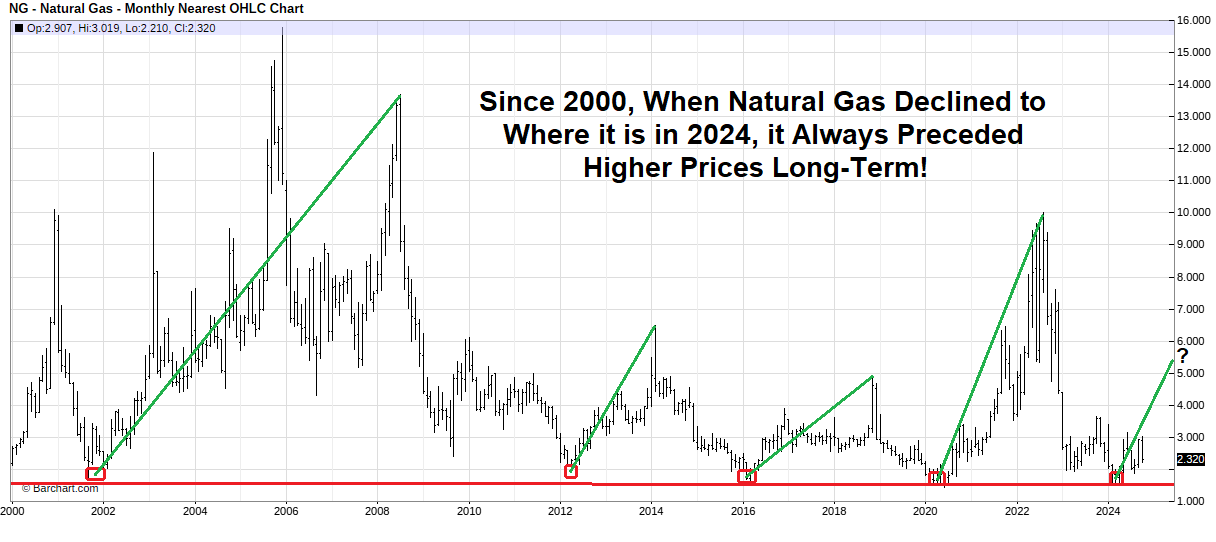

Hurricanes Helene & Milton an unexpected opportunity to secure Natural Gas and Electric rates before they move higher Long-Term?

Energy News: October 21st, 2024 Hurricanes Helene & Milton an unexpected opportunity to secure Natural Gas and Electric rates before